Introduction

The Deputy First Minister, John Swinney, set out “four important factors” in arriving at the measures announced in the 2023/24 Scottish Budget:

- The pressures on the public finances mean that in some cases, the Scottish Government’s plans will need to be delivered on a longer timescale than originally envisaged.

- The requirements for public sector reform, set out in the Medium Term Financial Strategy and the Resource Spending Review, will become ever more necessary. The Scottish Government will act in a way consistent with the principles of the Christie Commission, placing “significant emphasis” on early intervention and prevention.

- Significant increases in input prices and energy costs mean that the capital budget will be unable to deliver as much as would have been considered possible only a few months ago.

- An uncertain inflation outlook, and the need to still conclude some current year pay deals, mean that a public sector pay policy for 2023/24 will not be published until the new year.

Subject to these major constraints, Mr Swinney set out three priorities for “a different path” from that taken by the UK government:

- eliminating child poverty;

- prioritising the transition to net zero; and

- investing in public services.

Economic update

The Scottish Budget arrived towards the end of a busy week for economic news:

- On Monday the Office for National Statistics (ONS) published its latest monthly GDP estimate. The UK economy is estimated to have grown by 0.5% in October 2022, following a fall of 0.6% in the previous month. On a three-month view (August-October) GDP fell by 0.3%, suggesting the economy may already be in recession.

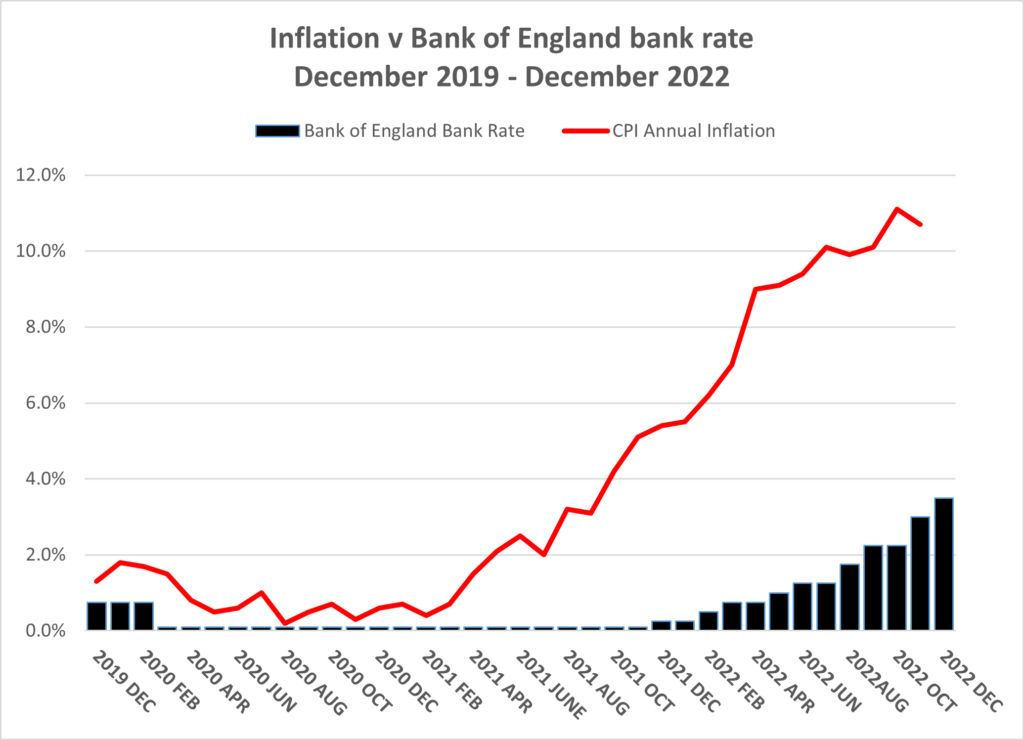

- On Tuesday the ONS turned its attention to employment with its latest labour market overview. This showed unemployment increasing marginally to 3.7%, still a historically low level. Worryingly for the Bank of England, the ONS reported earnings growth rising to 6.1% (6.9% in the private sector and 2.7% for the public sector).

- On Wednesday the latest inflation figures were issued. Annual CPI inflation in November was 10.7%, down 0.4 % from what appears likely to have been an October peak and 0.2 % below market expectations.

On Thursday, shortly before the Scottish Budget announcement, the Bank of England increased the Bank Rate for the ninth consecutive time in twelve months, raising the rate to 3.5%, its highest level since November 2008.

To this flood of pre-Budget data can be added the Autumn Statement – a UK Budget in all but name – delivered just four weeks ago by Jeremy Hunt, the latest Chancellor at Westminster. Clearly the Deputy First Minister, John Swinney, standing in for Kate Forbes, the Cabinet Secretary for Finance and the Economy currently on maternity leave, had no shortage of economic or fiscal challenges in preparing the Scottish Budget.

As part of that deputising role, last month Mr Swinney published an Emergency Budget Review in which he made clear that “The financial situation facing the Scottish Government is, by far, the most challenging since devolution”. To address what he said was a £1.7 billion projected 2022/23 budget shortfall, Mr Swinney announced a series of savings and spending cuts.

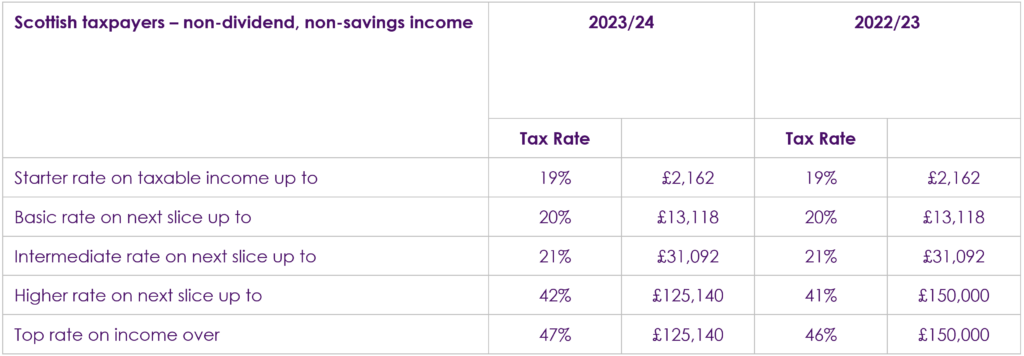

The measures in Mr Hunt’s Autumn Statement mean the Scottish Government will receive an additional £1.0 billion in 2023/24 and £0.8 billion extra in 2024/25 according to calculations in a pre-Budget report by the Fraser of Allander Institute (FAI). The Institute suggested that those sums would cover the impact of higher than assumed inflation on the spending budgets for those two years. Nevertheless, ahead of the Budget the outlook for spending looked to be heavily constrained. The Scottish Government’s May Spending Review implied that there would be real terms cuts in many areas between 2022/23 and 2023/24. Given that backdrop it is not surprising that Mr Swinney chose to follow some of Mr Hunt’s revenue-raising measures, such as freezing most income tax bands and reducing the threshold for the top rate of tax. However, he also introduced some additional tax-raising measures of his own.

Tax annouNcements

Income tax

The 2023/24 income tax bands will remain the same as for 2022/23, except for the top rate threshold which will fall to £125,140, in line with the reduction for the rest of the UK announced in the Autumn Statement.

The higher and top rates will both increase by 1% in 2023/24 to 42% and 47% respectively.

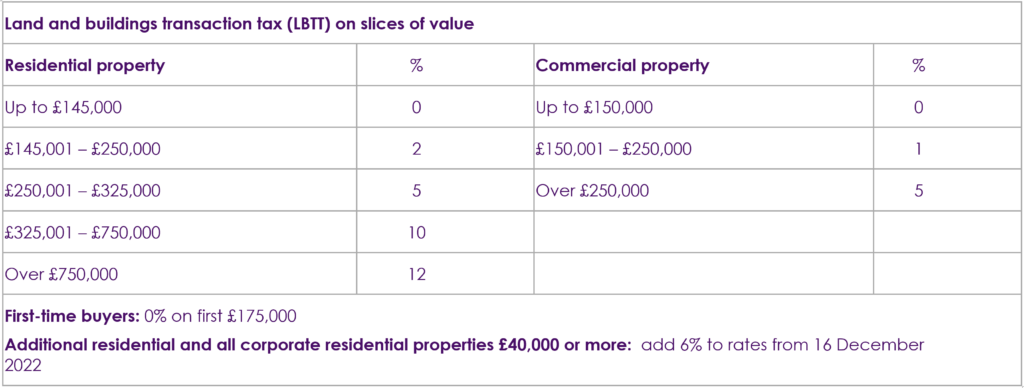

Land and buildings transaction tax (LBTT)

There will be no changes to the LBTT bands despite the now temporary reduction in stamp duty land tax in England following Kwasi Kwarteng’s September ‘mini-Budget’. However, the additional dwelling supplement will rise from 4% to 6% from 16 December 2022.

Scottish council tax rates

2022/23 was the first year since the SNP came to power in which councils were given complete freedom to increase council tax levels, and most did so by 3%. For 2023/24 the Scottish Government will again not seek to cap or freeze council tax rates.

Scottish non-domestic rates

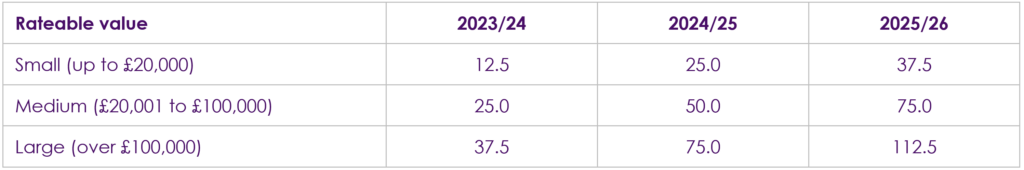

From April 2023 new rateable values will be introduced, based on property values as at

1 April 2022. The poundage will be frozen at 2022/23 levels. A new revaluation transitional relief will see increases in non-domestic rate liabilities due to revaluation capped (in cash terms), as detailed below:

Proposed year-on-year Scottish 2023 transitional relief caps (%)

The number of properties which are liable for the higher property rate will be reduced by an increase to £100,000 in the rateable value threshold.

The small business bonus scheme (SBBS) relief will be reformed and eligibility extended. 100% relief will be available for properties with a rateable value of up to £12,000 and the upper rateable value for individual properties to qualify for SBBS relief will be extended from £18,000 to £20,000.

SBBS relief will taper from:

- 100% to 25% for properties with rateable values between £12,001 to £15,000; and

- 25% to 0% for properties with rateable values between £15,001 to £20,000.

Cumulative rules will remain in place including the £35,000 cumulative rateable value threshold. Car parks, car spaces, advertisements and betting shops will be excluded from eligibility for SBBS from 1 April 2023.

A phased small business transitional relief will be introduced for properties that lose SBBS or rural rates relief. For those losing or seeing a reduction in these reliefs on 1 April 2023 (including due to the above exclusions introduced for SBBS relief) the maximum increase in the rates liability relative to 31 March 2023 will be capped at:

- £600 in 2023/24;

- £1,200 in 2024/25; and

- £1,800 in 2025/26.

Scottish landfill tax

The standard rate of Scottish landfill tax will increase from £98.60 a tonne to £102.10 a tonne and the lower rate from £3.15 a tonne to £3.25 a tonne from 1 April 2023 to maintain consistency across the UK.

Other announcements

- The Scottish Child Payment will remain at the level of £25 per eligible child per week,

- Other social security benefits under Scottish Government control will be increased by 10.1%, the rate of CPI inflation in September 2022.

- Spend on Health and Social Care in Scotland will increase by over £1 billion, with a large slice funded through the changes to income tax.

- Local government will receive additional resources of over £550 million in 2023/24.

- An investment of £244 million will be made in the Scottish National Investment Bank to support the transition to net zero.

- Funding available to the Crown Office and Procurator Fiscal Service will rise by £13 million. The Justice system will receive an additional £165 million, approximately half of which is allocated to funding police services.

- £50 million will be invested in the next phase of the Just Transition Fund for the North East and for Moray.

- A £30 million investment will be made in childcare services.

- The resources available to the college and university sectors will be increased by £26 million and £20 million respectively.

- The £20 million of funding set aside for a referendum on Scottish Independence (indyref2) will instead be applied to extending the Fuel Insecurity Fund into next year.

- £15 million in this financial year and £57 million in the next financial year will be allocated to support the completion of vessels 801 and 802 at Ferguson Marine, along with the resources required to build the two new Islay class vessels under construction, and a further two vessels of the same type currently in procurement.