Tax planning is key to optimising tax relief and allowances for a robust financial plan for life, work and family.

Welcome to the ammu

Tax Planning + Advice Hub

ammu Hub Expert Emily Wilson

Our hub gives you the facts, case studies and resources to help with tax planning and plan for the future.

We’ll give you the advice and support you need to optimise your tax relief and allowances and make the right decisions for you today and for tomorrow.

Recent News + Blogs

Spring Statement 2025 – Ammu’s Commentary

Rachel Reeves’ Spring Statement brings few surprises but confirms that key tax and compliance changes are going ahead as planned. Key points for you as a business owner: Helpful Articles for MTD and Payroll Updates Making Tax Digital: Key Changes […]

Making Tax Digital: Key Changes from April 2026

From April 2026, HMRC is rolling out Making Tax Digital (MTD) for Income Tax, which will impact many self-employed individuals and landlords. If you earn over £50,000 from employment or property, you’ll likely be affected—so it’s time to start preparing. […]

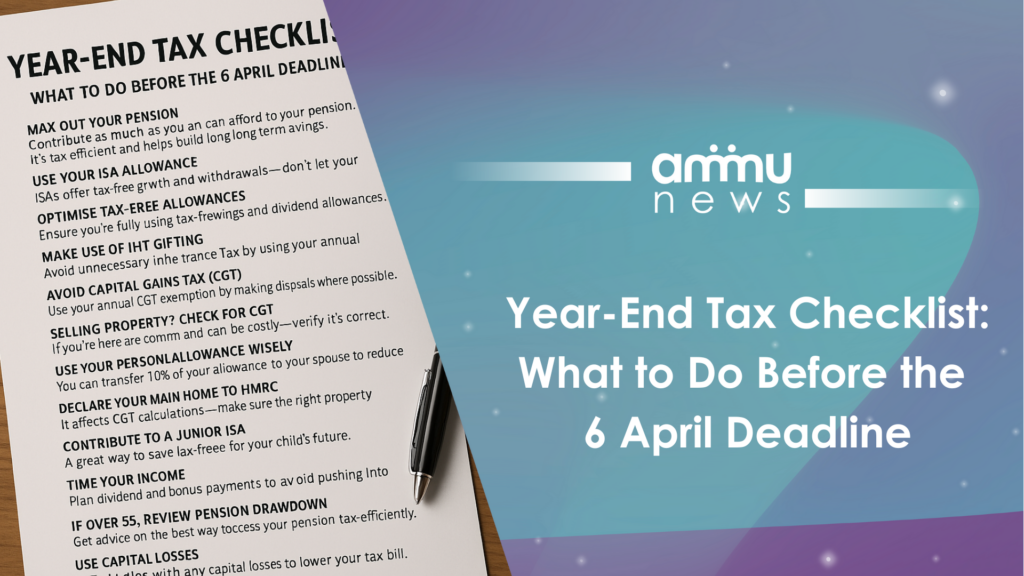

Year-End Tax Checklist: What to Do Before the 6 April Deadline

As the tax year-end approaches, now’s the time to take action and make the most of valuable allowances and planning opportunities. Here are 15 practical steps to consider before 6 April 2025

Spring Forecast 2025: What to Expect on 26 March

Cast your mind back six Chancellors ago to Philip Hammond (aka Spreadsheet Phil). In autumn 2016, Hammond announced a change to the timings of Budget announcements, with a Spring Budget and Autumn Pre-Budget Report (PBR) to be replaced by an Autumn Budget and a Spring Statement.

Start 2025 Right: Year-End Tax Planning Tips to Know

As 2025 gets under way, it is once again the time of year to start considering your tax year-end planning.

Autumn Budget 2024

The first Budget from a Labour government since March 2010, and the first ever from a female Chancellor, proved to be the defining event that had been widely anticipated. From the moment in late July when Rachel Reeves unveiled her […]

Autumn Budget 2024 – Highlights

The Autumn Budget 2024 introduces a range of significant tax and financial adjustments aimed at addressing fiscal pressures and funding essential services. Here are the key changes, from national insurance increases to adjustments in inheritance tax and property levies, that […]

Autumn Budget 2024 – NI Contributions

The 2025/26 National Insurance Contributions (NICs) framework, as outlined in the Autumn Budget, includes adjustments to rates and thresholds impacting employees, employers, and the self-employed. This table provides an overview of NICs rates, exemptions, and key limits, including employer contributions […]

Autumn Statement – Personal Tax

Income tax The personal allowance will remain at £12,570 for 2024/25 and the higher rate threshold will stay at £50,270, both levels that first took effect in 2021/22. The blind person’s allowance will be increased to £3,070 for 2024/25. In […]

Autumn Budget 2024 – Personal Taxation tables

The following tables summarize the main personal tax rates, allowances, and reliefs set out in the Autumn Budget 2024. Covering income tax bands, savings, dividend allowances, and specific provisions for Scottish taxpayers and trusts, these tables provide a quick reference […]

Increased income – the double-edged sword

Increased income means more than just taxes. Lost benefits & higher tax rates loom. Pensions & ISAs can help navigate the tax trap.

Moving to Scotland – the cost in tax

Calculate the tax impact of relocating to Scotland. Understand income tax rates, bands, and changes from April 2024.

Are You Owed Money? Exploring Unclaimed Pension Tax Relief in the UK

Did you know that over £1.3 billion of pension tax relief has gone unclaimed by the highest earners in the UK? The pension provider PensionBee analysed unclaimed pension relief between 2016 and 2021, and revealed a staggering amount of unclaimed […]

Taxing wealth – a viable option?

As we look ahead to the Budget on March 3 – a full update will be published on ammu.uk shortly after the Chancellor’s statement – it is worth looking at some of the issues that may well be under consideration. […]

Reclaiming overpaid inheritance tax

Inheritance tax (IHT) is expected to raise £37 billion over the next five years – £10 billion more than in the past five years. But IHT is sometimes overpaid and it is reported that families have made 32,000 claims for IHT […]

Could an employee ownership model help you to build a better business?

Businesses such as John Lewis are famous for being pioneers of the employee ownership model. When employees own a stake in a company it can create a positive culture. Businesses tend to move to an employee-owned model at different points […]

Spring Statement Summary

Most of the announcements made by UK Chancellor Jeremy Hunt will have a significant impact on our personal finances. The energy price guarantee will continue until July, the fuel duty rise has been cancelled and the lifetime allowance for pensions […]Guides, Factsheets + Events

-

UK and Scotland Personal and Business Tax Rates

Tax rates, reliefs and allowances: UK and the Scottish income and property taxes. -

Tax Matters

With ideas affecting income and investment, for couples, company directors and employees, and self-employed people, there will be something for everyone. -

Tax Services

How can you make tax work for you? Effectively managing your tax affairs