The UK tax gap has reached an estimated £46.8 billion for 2023/24, with 5.3% of total taxes going unpaid. HMRC will be concerned that small businesses are responsible for 60% of the missing taxes. The tax gap for corporation tax […]

Category: Tax Planning

Company Accounts Changes Ahead

Directors need to prepare for company accounts changes from Companies House, which will take effect from 1 April 2027. Digital software Directors who currently submit their company accounts themselves will no longer be able to file by paper or use […]

Is Now a Good Time to Be a Landlord?

Is now a good time to become a landlord in England? With more mortgage deals and lower interest rates, many wonder if this is the moment to invest in buy-to-let. Cons Uncertainty remains in the private rental market due to […]

HMRC Struggles to Tax Interest Income

Taxpayers relying on HMRC to correctly calculate tax on interest are being warned: the system is under strain, and personal responsibility is key.

Business and Agricultural IHT Relief: What the £1M Limit Means

HMRC’s recently closed consultation offers further clarity on how the new £1 million inheritance tax (IHT) relief cap for business and agricultural property will apply from 6 April 2026.

Spring Statement: Tax Rises Still on the Horizon

There were no tax increases in the Chancellor’s Spring Statement (upgraded from an initial Spring Forecast), but that might just be pain deferred.

Spring Statement 2025 – Ammu’s Commentary

Rachel Reeves’ Spring Statement brings few surprises but confirms that key tax and compliance changes are going ahead as planned. Key points for you as a business owner: Helpful Articles for MTD and Payroll Updates Making Tax Digital: Key Changes […]

Making Tax Digital: Key Changes from April 2026

From April 2026, HMRC is rolling out Making Tax Digital (MTD) for Income Tax, which will impact many self-employed individuals and landlords. If you earn over £50,000 from employment or property, you’ll likely be affected—so it’s time to start preparing. […]

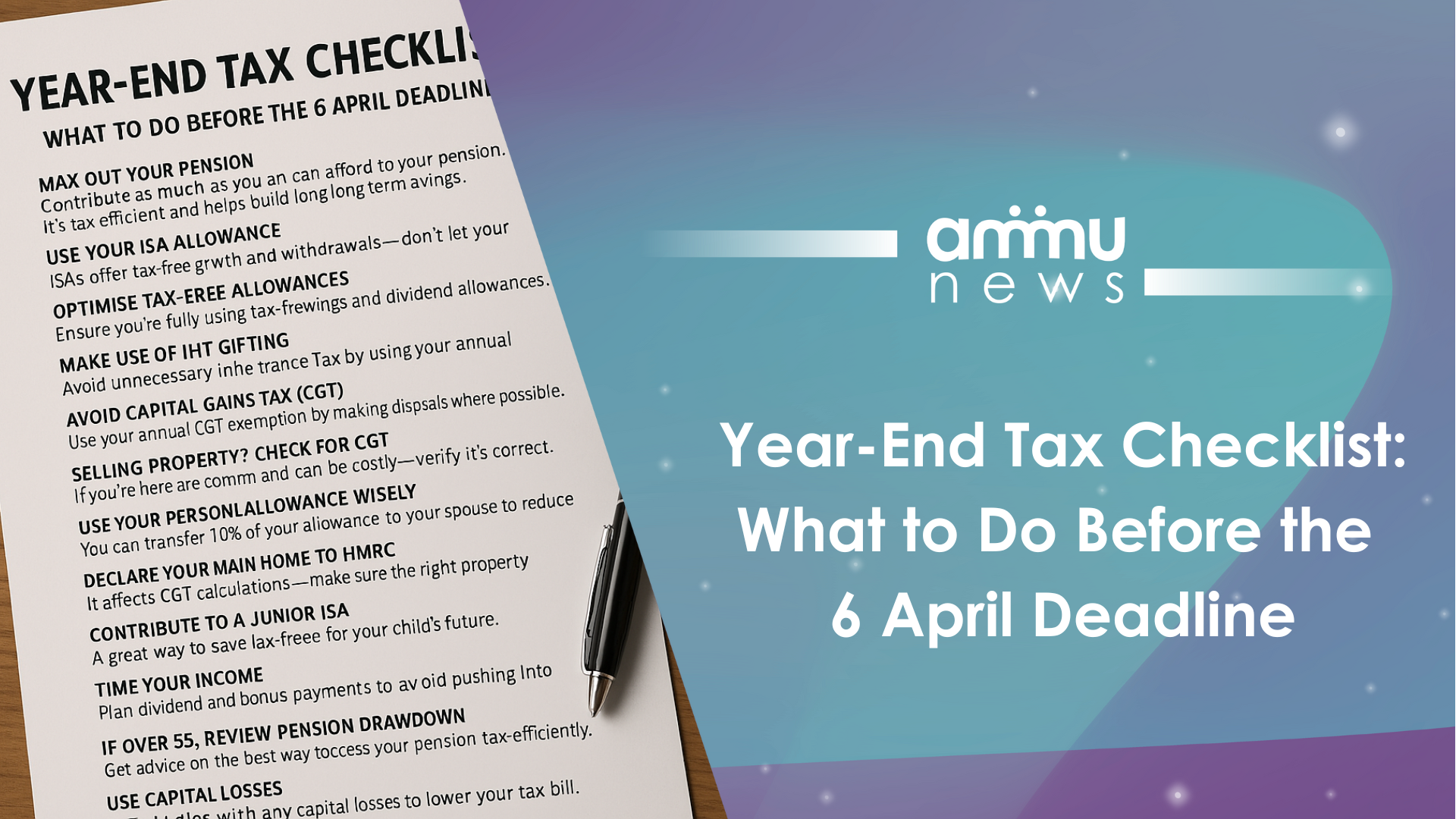

Year-End Tax Checklist: What to Do Before the 6 April Deadline

As the tax year-end approaches, now’s the time to take action and make the most of valuable allowances and planning opportunities. Here are 15 practical steps to consider before 6 April 2025

Changes to NIC Rates & Thresholds: What This Means for Your Business

Following the Autumn Budget in 2024, the new National Insurance (NI) changes are coming into effect from 6 April 2025. It’s important to understand how these adjustments will impact your business. Whether you’re a sole director of a limited company […]

How Capital Gains Tax Changes Could Impact Receipts and Planning Strategies for Investors and Landlords

Raising tax rates is a traditional government strategy to increase tax receipts for HMRC, but this may not be the case for capital gains tax (CGT).

Dividend allowance cut doubles taxpayers

With the dividend allowance now cut to just £500, the number of taxpayers paying tax on dividend income for 2024/25 is expected to be double what it was three years ago.

Funding Matters

Funding Matters Digitisation Matters

Digitisation Matters Strategy + Planning

Strategy + Planning Tax Planning + Advice

Tax Planning + Advice R&D Tax Hub

R&D Tax Hub