PERSONAL TAXATION

INCOME TAX

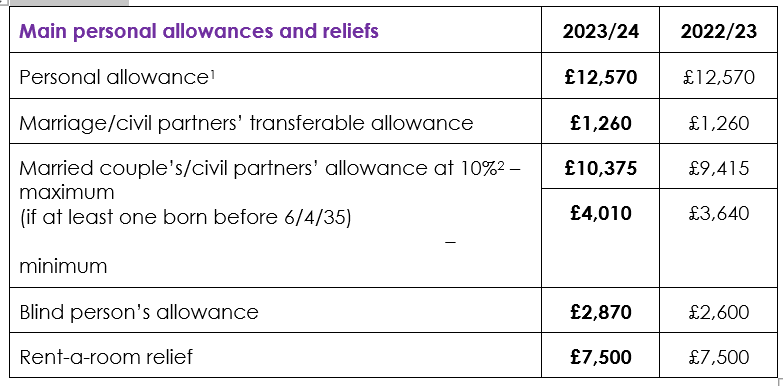

1 Personal allowance reduced by £1 for every £2 of adjusted net income over £100,000.

2 Reduced by £1 for every £2 of adjusted net income over £34,600 (£31,400 for 2022/23), until the minimum is reached.

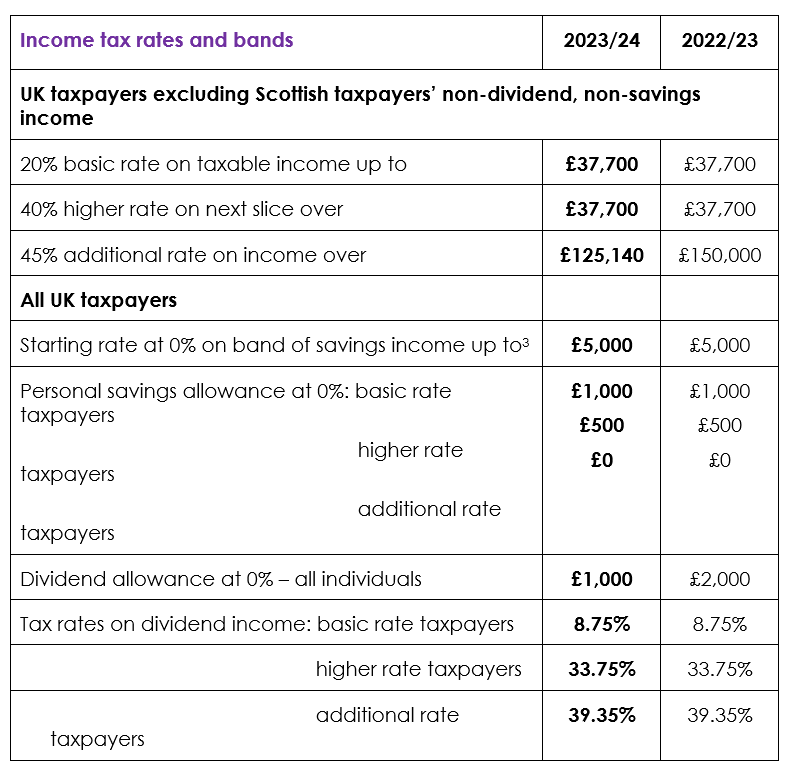

3 Not available if taxable non-savings income exceeds the starting rate band.

Income tax

For 2023/24 to 2027/28, the personal allowance will remain at £12,570 and the higher rate threshold at £50,270, as previously announced. The additional rate threshold for 2023/24 will be reduced to £125,140.

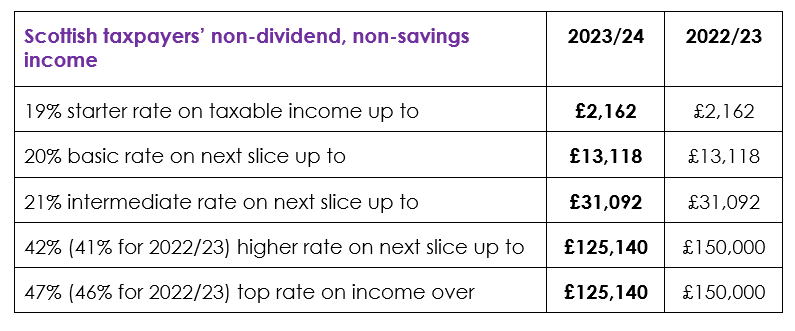

In Scotland, the starter, basic and intermediate rate bands will be unchanged for 2023/24, while the higher rate threshold will be frozen and the higher rate tax rate will be increased to 42%. The top rate threshold will be cut to £125,140 and the top rate will rise by 1% to 47%.

SAVER

Don’t lose your personal allowance. Your personal allowance of £12,570 is reduced by £1 for every £2 of income between £100,000 and £125,140. You may be able to make a pension contribution or a charitable gift to bring your income below £100,000.

Savings rate band

The 0% band for the starting rate for savings income for 2023/24 will remain at its current level of £5,000.

Dividend tax

The dividend allowance will reduce to £1,000 for 2023/24 and to £500 for 2024/25, as announced last November. The rates of tax on dividends above the dividend allowance will remain unchanged.

National insurance contributions (NICs)

The upper earnings limit, upper secondary thresholds and upper profits limit will remain aligned to the unchanged higher rate threshold at £50,270 for 2023/24 to 2027/28, as previously announced. The Class 1 primary threshold of £12,570 and secondary threshold of £9,100 will remain frozen until April 2028. The NIC rates are unchanged.

Company car tax

The company car tax rates for 2023/24 will remain frozen for 2024/25. As announced in the Autumn Statement, the rates for electric and ultra-low emission cars will increase by one percentage point in each of 2025/26, 2026/27 and 2027/28. These will be subject to a maximum percentage of 5% for electric cars and 21% for ultra-low emission cars. The rates for all other bands of vehicles will be increased by one percentage point for 2025/26 up to a maximum percentage of 37%; they will then be fixed for 2026/27 and 2027/28.

You can also read our our highlights of Spring Budget 2023 Summary

Get in touch

If you would like to discuss your tax matters with our expert email Emily Wilson at info@ammu.uk or call 01292 388 031