PERSONAL TAXATION INCOME TAX 1 Personal allowance reduced by £1 for every £2 of adjusted net income over £100,000.2 Reduced by £1 for every £2 of adjusted net income over £34,600 (£31,400 for 2022/23), until the minimum is reached. 3 […]

Category: Tax Planning

Spring Statement Summary

Most of the announcements made by UK Chancellor Jeremy Hunt will have a significant impact on our personal finances. The energy price guarantee will continue until July, the fuel duty rise has been cancelled and the lifetime allowance for pensions […]

New points-based penalties for late VAT returns

A new points-based penalty applies to late VAT returns for VAT periods beginning on or after 1 January 2023. The first monthly return to be affected was the one due by 7 March, with the first affected quarterly return due […]

Winding-up petitions on the rise in HMRC squeeze

HMRC’s use of winding-up petitions to actively chase the money it is owed comes at the worst possible time as many companies struggle to cope with inflationary pressures,

Pay attention to tax codes

The easiest way a person can check and correct a tax code is by logging onto their personal tax account using their Government Gateway user ID and password.

Personal Tax Year Ending – Take These Actions Now

The end of the tax year is just around the corner, so it’s time to get your tax matters in order. Set aside a few moments now to review your finances before the end of the tax year to optimise […]

Super Deduction Scheme Ending

Did you know the Super Deduction Scheme Ends on 31 March 2023? The good news is there is still time to take advantage of this opportunity to grow your business with the Super Deduction allowance before the incentive runs out. […]

Profit withdrawal changes for 2023/24

From 1 April 2023, the current 19% rate of corporation tax will only be available for the first £50,000 of profits.

Tax warnings for online sellers, influencers and content creators

HMRC’s latest wave of ‘nudge letters’ has been targeted at online sellers, influencers and content creators warning them that they may not have paid enough tax.

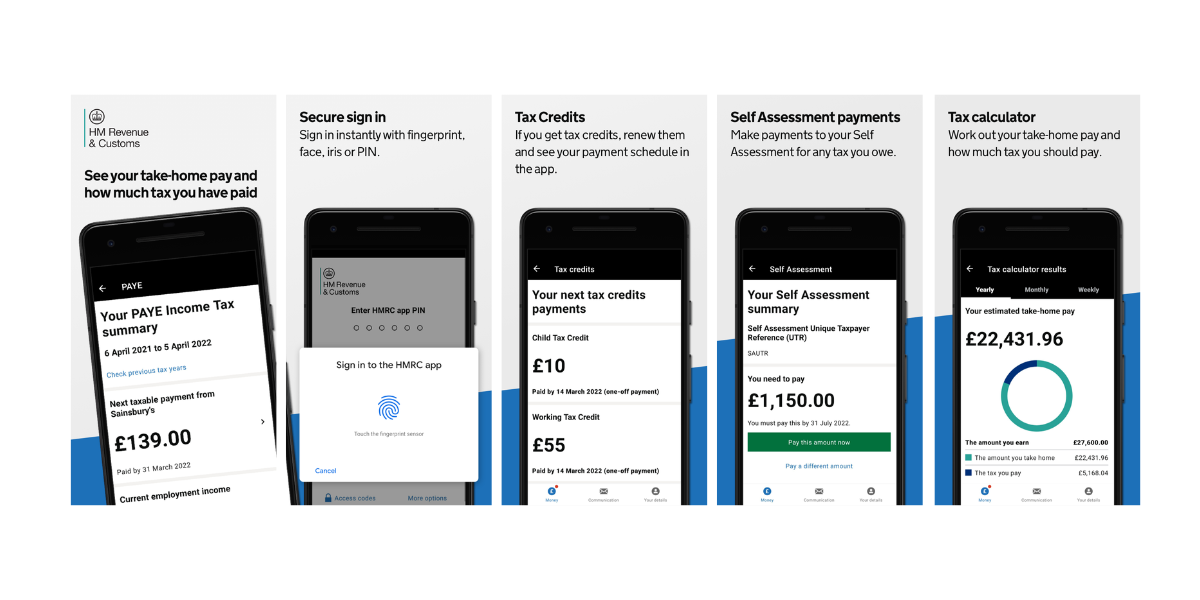

21st century Revenue – HMRC’s app and new texting service

HMRC’s app was launched a year ago and is gaining in popularity as it is being used to pay self-assessment tax bills.

Making Tax Digital delayed once more

With the self-employed and landlords facing a challenging economic environment, the government has again delayed the introduction of the Making Tax Digital (MTD) scheme for income tax self-assessment (ITSA) – this time by two years until April 2026. Although the […]

Funding Matters

Funding Matters Digitisation Matters

Digitisation Matters Strategy + Planning

Strategy + Planning Tax Planning + Advice

Tax Planning + Advice R&D Tax Hub

R&D Tax Hub