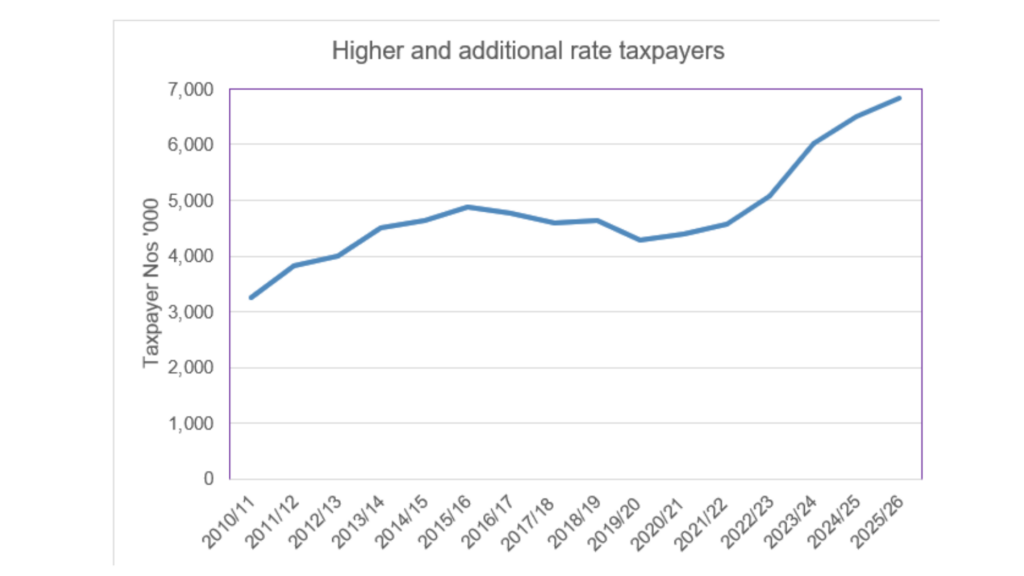

Higher rate taxpayer numbers are rising sharply, and if that’s you, then advice is now more important than ever.

Source: ONS data, OBR projections.

There was once a time when paying tax at more than the basic rate made you a member of a somewhat select club. In 2010/11, the first year in which additional rate tax was introduced, the proportion of taxpayers who were taxed at more than the basic rate was 10.4%. Five years later, a dose of austerity pushed the figure close to 16%. Then it began to drop as higher rate thresholds were raised, so that by 2019/20 it was down to 13.6%. From that low, the upward path was resumed.

Alongside the Chancellor’s Spring Statement in March, the Office for Budget Responsibility (OBR) issued estimates that the freeze in the personal allowance and, outside Scotland, and basic rate bands through to 2025/26 will mean by that year almost 19% of taxpayers will be liable for higher rate tax. The number of taxpayers will also be increasing too because of the personal allowance staying at £12,570. The rising taxpayer numbers explain why the Chancellor could announce a 1p cut in basic rate tax in 2024/25 at the same time as the OBR calculated that income tax revenue for the year would increase by £12 billion. Scotland already has a starter rate of 19%.

If your head is spinning from all the numbers, there is a simple message you: you are likely to pass more of your income to HMRC in the coming years. To limit just how much extra the Exchequer gains and you lose, there are plenty of actions to consider wherever you are in the UK:

- If you are married or in a civil partnership, make sure you are maximising the benefits of independent tax and, if you are eligible, claiming the transferable marriage allowance.

- Check your PAYE code – it could be wrong.

- Ensure you are claiming full tax relief on the pension contributions you make. Do not assume this will be given automatically, especially if you pay higher rate tax.

- Consider an ISA first for any investment as it is free from UK income tax and capital gains tax.

- Choose any employee perks with care. Some are highly tax efficient, while others carry a heavy tax burden.

Remember that if you are or likely to become a member of the ever-expanding higher rate taxpayer club, the value of financial advice rises with your tax rate.