A new business energy support scheme is set to run from 1 April 2023 to 31 March 2024 but will be less generous than the scheme currently in effect.

news

Tax warnings for online sellers, influencers and content creators

HMRC’s latest wave of ‘nudge letters’ has been targeted at online sellers, influencers and content creators warning them that they may not have paid enough tax.

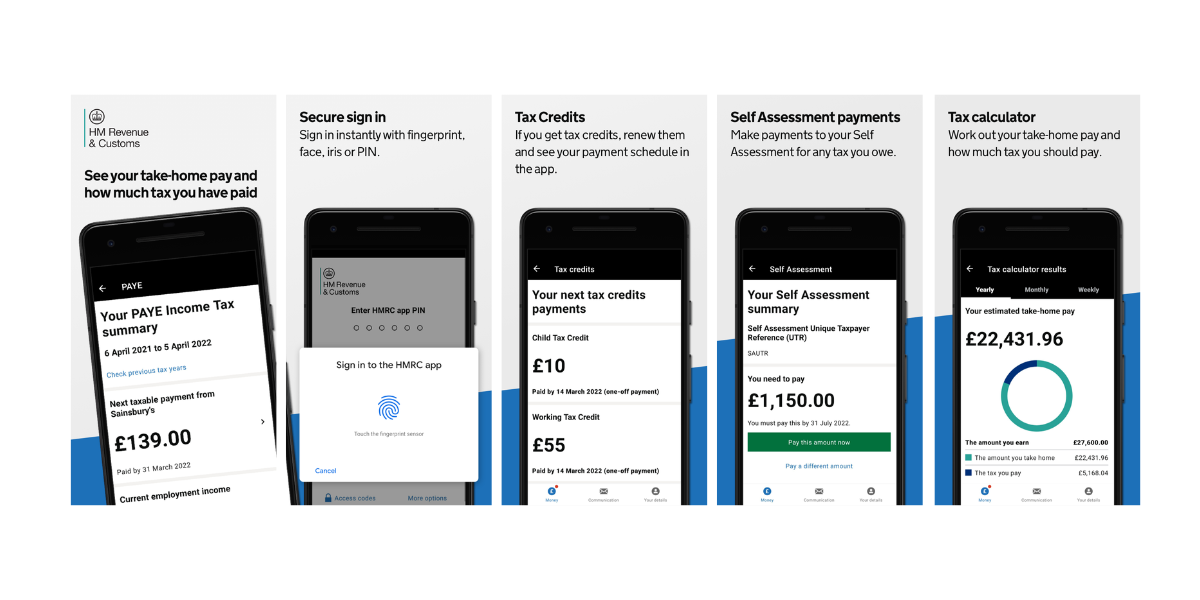

21st century Revenue – HMRC’s app and new texting service

HMRC’s app was launched a year ago and is gaining in popularity as it is being used to pay self-assessment tax bills.

Company cars: not-so-free fuel

If your employer pays for the fuel in your company car, it may cost you more than you expected.

High-Income Child Benefit Charge: penalties and defaults

New data reveals that penalties issued by HMRC for not paying the High-Income Child Benefit Charge (HICBC), or paying the incorrect amount, have fallen significantly.

Making Tax Digital delayed once more

With the self-employed and landlords facing a challenging economic environment, the government has again delayed the introduction of the Making Tax Digital (MTD) scheme for income tax self-assessment (ITSA) – this time by two years until April 2026. Although the […]

Funding Matters

Funding Matters Digitisation Matters

Digitisation Matters Strategy + Planning

Strategy + Planning Tax Planning + Advice

Tax Planning + Advice R&D Tax Hub

R&D Tax Hub