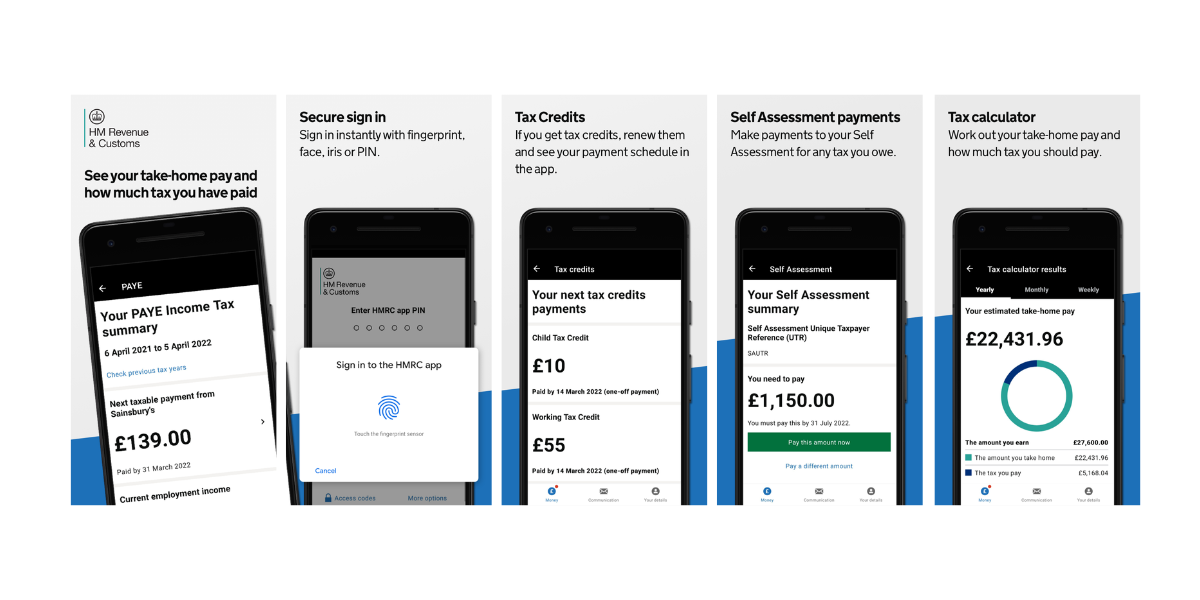

HMRC’s app was launched a year ago and is gaining in popularity as it is being used to pay self-assessment tax bills.

Category: All News

Company cars: not-so-free fuel

If your employer pays for the fuel in your company car, it may cost you more than you expected.

High-Income Child Benefit Charge: penalties and defaults

New data reveals that penalties issued by HMRC for not paying the High-Income Child Benefit Charge (HICBC), or paying the incorrect amount, have fallen significantly.

Making Tax Digital delayed once more

With the self-employed and landlords facing a challenging economic environment, the government has again delayed the introduction of the Making Tax Digital (MTD) scheme for income tax self-assessment (ITSA) – this time by two years until April 2026. Although the […]

Funding Matters

Funding Matters Digitisation Matters

Digitisation Matters Strategy + Planning

Strategy + Planning Tax Planning + Advice

Tax Planning + Advice R&D Tax Hub

R&D Tax Hub