From 6 April 2026, the EMI Schemes (Enterprise Management Incentive) rules will change in a way that significantly broadens who can use them. For many growing and scaling businesses, this is not just a technical update but a genuine opportunity […]

Author: Sarah Shannon

Key UK Financial Dates to Be Aware of in 2026

The Dates to Put in Your Financial Diary Now! As we move through 2026, a number of important financial changes and deadlines will affect individuals, landlords and business owners alike. By knowing what’s coming up and when, you can plan […]

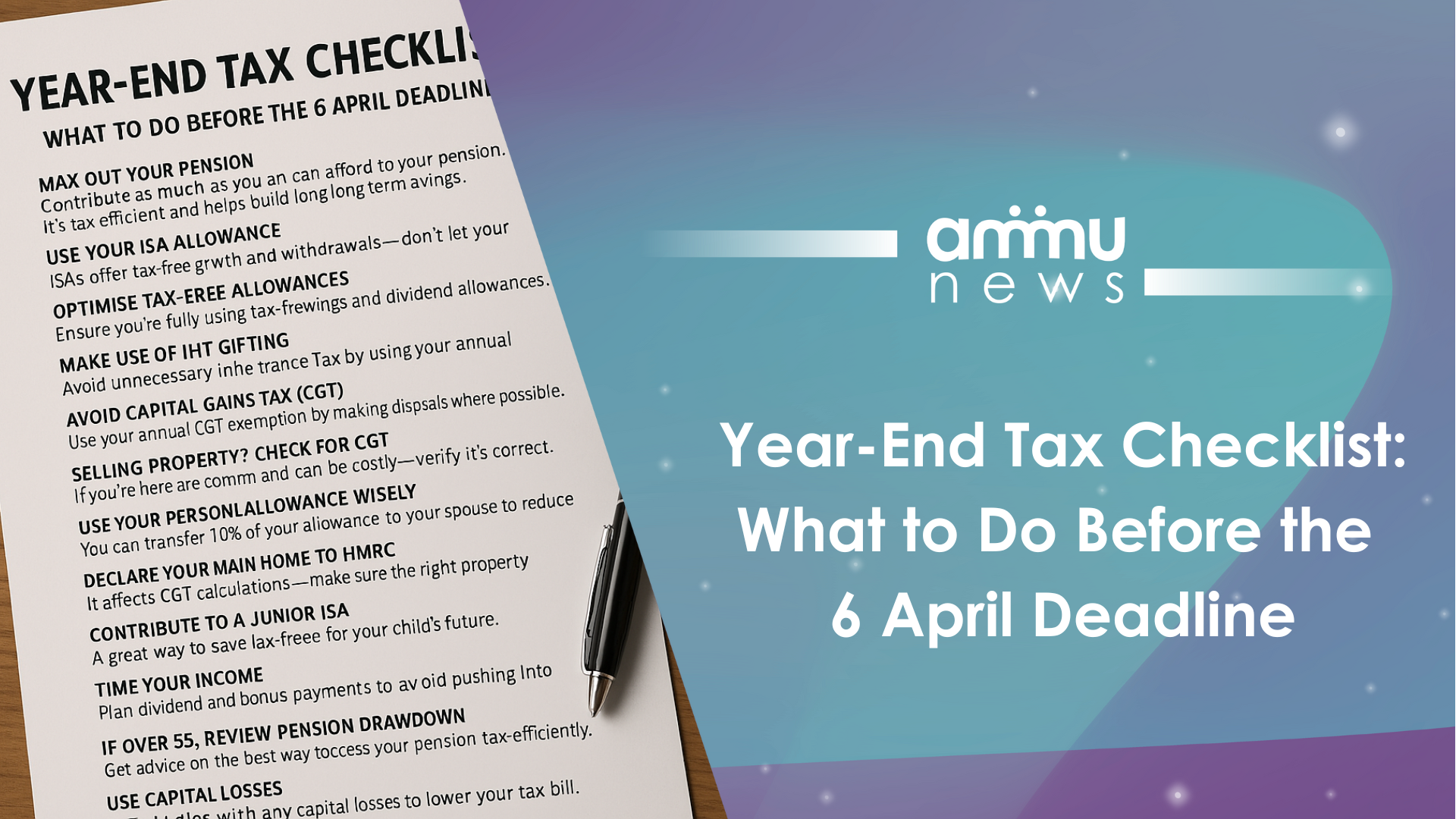

Year-End Tax Checklist: What to Do Before the 6 April Deadline

As the tax year-end approaches, now’s the time to take action and make the most of valuable allowances and planning opportunities. Here are 15 practical steps to consider before 6 April 2025

Changes to NIC Rates & Thresholds: What This Means for Your Business

Following the Autumn Budget in 2024, the new National Insurance (NI) changes are coming into effect from 6 April 2025. It’s important to understand how these adjustments will impact your business. Whether you’re a sole director of a limited company […]

The Key to Thriving in 2025?

The Autumn Budget led to big changes that businesses can’t afford to ignore. Rising National Insurance contributions, higher wage costs, and shifts in tax policies are reshaping the financial landscape. For businesses, staying ahead means having clear, real-time financial insights […]

New Chapter for Ammu

We’re excited to share some significant news with you! After an impressive 22-year journey in the accounting industry, our Co-founder and Director, Jane Grant, has decided to retire. Jane has been an integral part of Ammu’s growth, playing a vital […]

Spotlight on a City Centre Business: Elizabeth Bandeen – Massage Therapist Glasgow.

City centre businesses are currently facing tough challenges due to the pressures of LEZ regulations, bus gates, parking charges, and the ever-changing ScotRail timetable. Yet, clients like the tenacious Elizabeth Bandeen continue to adapt and thrive. This latest client spotlight […]

New £500 Income Exemption for Trusts Starting 6 April 2024: Benefits and Complexities

The introduction of a £500 income exemption from 6 April 2024 will impact many trusts.

Analysing the Spring Budget Impact:

What was almost certainly the last Budget before the election was a serving of the widely expected, sprinkled with a handful of small surprises.

Scottish Budget: Additional Announcements

Some other announcements worth sharing include: You can read our Scottish budget economic summary and Scottish budget tax announcements Get in touch today for expert accounting and tax advice.

Income tax saving opportunities

Switching income from one spouse or partner to the other can help save tax. Everyone should make sure they use their personal allowance (a maximum of £12,570 in 2023/24, and frozen at this level until 2027/28). For couples, if either […]

Making the dividend or bonus decision

The end of the tax year is drawing near and many owner-directors of companies are putting their minds to deciding which is more tax-efficient: a bonus or a dividend. Tax laws and rates that will affect your decision have changed […]

Funding Matters

Funding Matters Digitisation Matters

Digitisation Matters Strategy + Planning

Strategy + Planning Tax Planning + Advice

Tax Planning + Advice R&D Tax Hub

R&D Tax Hub