· On the Thursday the Bank of England had announced its third consecutive interest rate freeze. The day before the US Federal Reserve had also frozen its main interest rate. However, whereas the US central bank had indicated there could be three cuts to rates in 2024, the Bank of England painted a gloomier picture, suggesting that “Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures”.

· The estimate of monthly economic growth from the Office for National Statistics (ONS) released on 13 December showed UK GDP falling by 0.3% in October, with all three sectors – services, production and construction – posting declines. That left the economy the same size as at the start of the year. In the minutes accompanying its interest rate decision, the Bank of England said that it expected growth “to be broadly flat in 2023 Q4 and over coming quarters”.· The day before, the ONS labour market overview revealed little change in the unemployment rate at 4.2% and a 0.8% fall in the annual growth in regular pay (including bonuses) to 7.2% in August–October 2023. Earnings growth is a continued concern for the Bank of England which said on Thursday “There remain upside risks to the outlook for wage growth”.

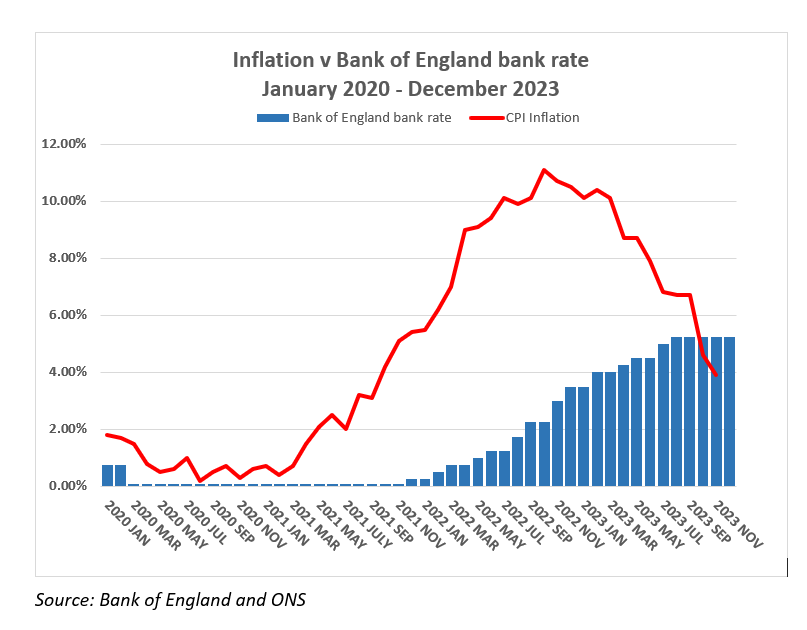

The November CPI annual inflation rate, published on the day following the Budget, was 3.9%. Looking further out, the Bank of England forecast that figure would fall to 2.2% by the end of 2025.

To the previous week’s economic news can be added the forecasts made by the Office for Budget Responsibility (OBR) that appeared alongside November’s Autumn Statement – once again close to a UK Budget in all but name. The OBR cut its growth projections by 1.1% for both 2024 and 2025 but raised its inflation assumptions. The latter gave the Chancellor enough wiggle room to cut two national insurance rates, make full expensing of business investment permanent and still leave the UK tax burden rising in each of the next five years to a post-war record level.

The measures in Jeremy Hunt’s Autumn Statement meant that the Scottish Government will receive additional block grant funding of £223 million in 2023/24 and £321 million extra in 2024/25 according to calculations in a post-Autumn Statement note published by the Fraser of Allander Institute (FAI).

Nevertheless, ahead of the Scottish Budget the outlook for spending by the Scottish government in 2024/25 was heavily constrained. In the six months between the publication of the Scottish government’s Medium Term Financial Strategy in May, and its Autumn Budget Revision, spending had increased by an estimated £930 million, prompting the Cabinet Secretary for Finance to announce “savings and funding prioritisation” of £680 million on the day before Jeremy Hunt’s Autumn Statement.